Kentucky K

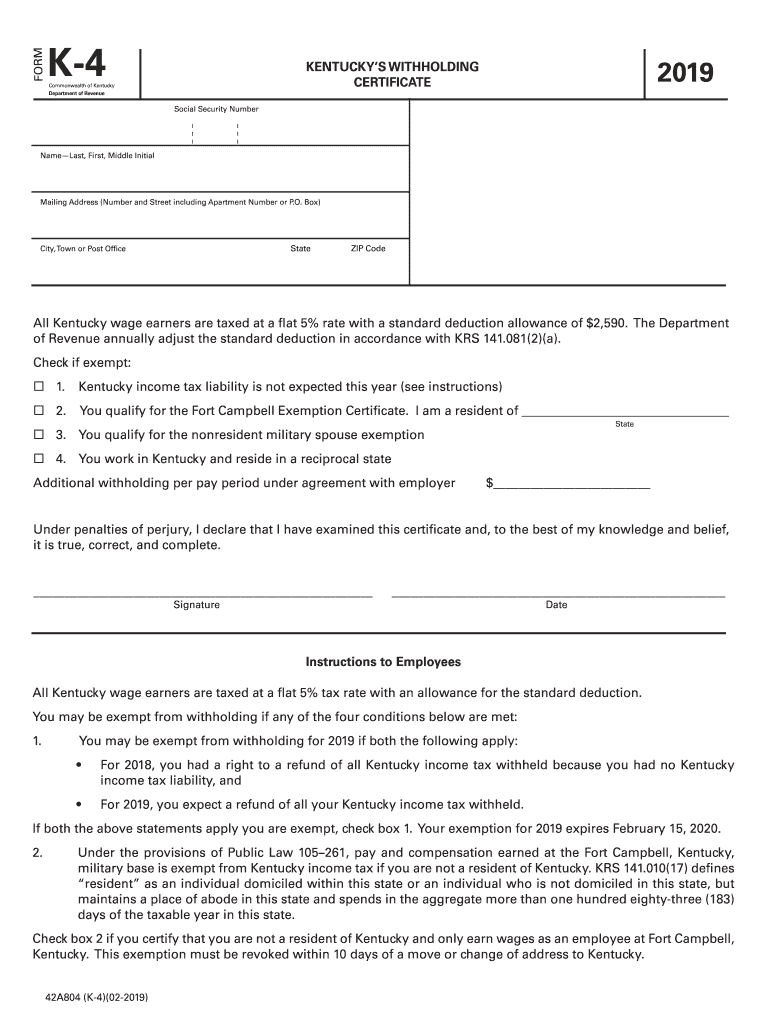

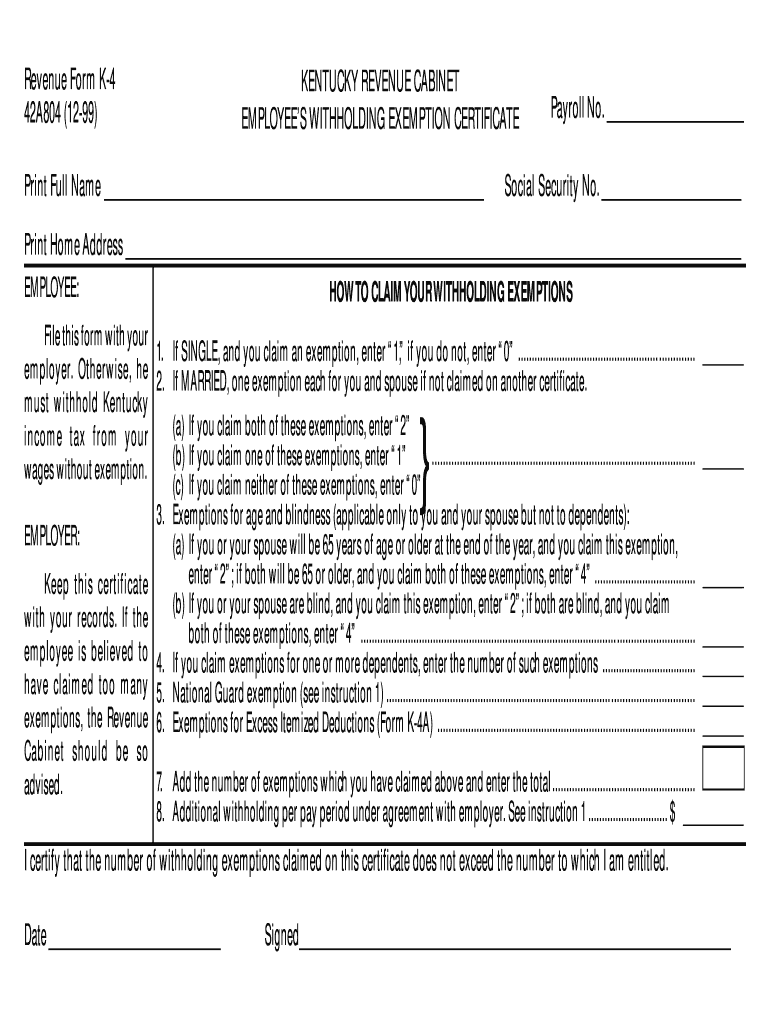

Kentucky K-4 Form 2025. Krs 156.160 (1) (i) requires proof of a vision examination by an optometrist or ophthalmologist. The kentucky department of revenue sept.

This amount will be incorporated into 2025 tax forms and should be used for tax planning in the new year.

Kentucky K4 App, Krs 156.160 (1) (i) requires proof of a vision examination by an optometrist or ophthalmologist. Download the taxpayer bill of rights.

2025 KY DoR 42A804 Form K4 Fill Online, Printable, Fillable, Blank, The kentucky department of revenue sept. Kentucky state income tax withholding.

Kentucky K4 App, Social security number name—last, first, middle. Krs 156.160 (1) (i) requires proof of a vision examination by an optometrist or ophthalmologist.

TSC Recruitment 2025/2025 Application Form Portal www.tsc.go.ke, The kentucky department of revenue dec. Krs 156.160 (1) (i) requires proof of a vision examination by an optometrist or ophthalmologist.

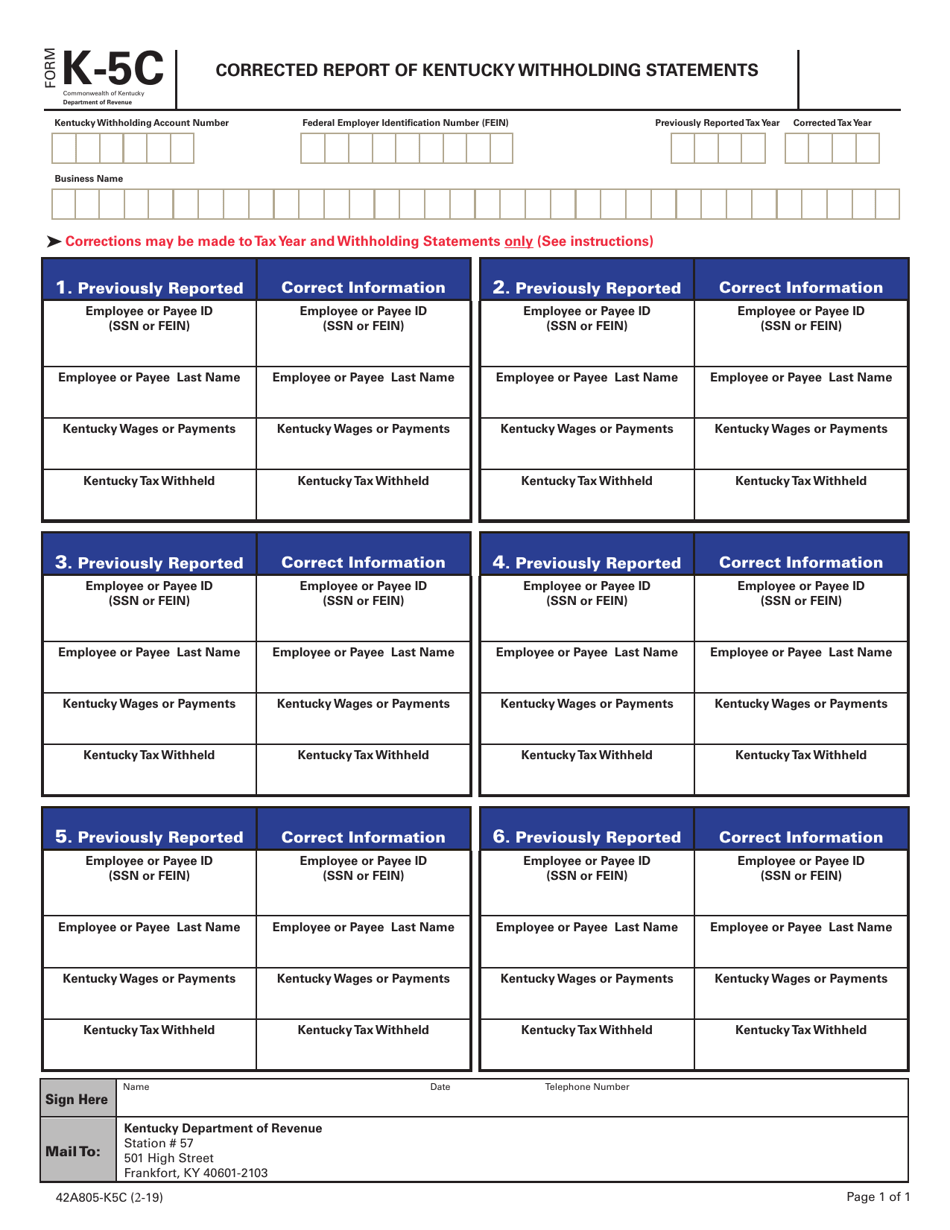

Form K5C Fill Out, Sign Online and Download Fillable PDF, Kentucky, After completing and electronically signing the. Compared to the 2025 version, the formula’s standard deduction.

imperialpricedesign K 4 Form Kentucky, I lived in tennessee and worked on base at fort campbell. Compared to the 2025 version, the formula’s standard deduction.

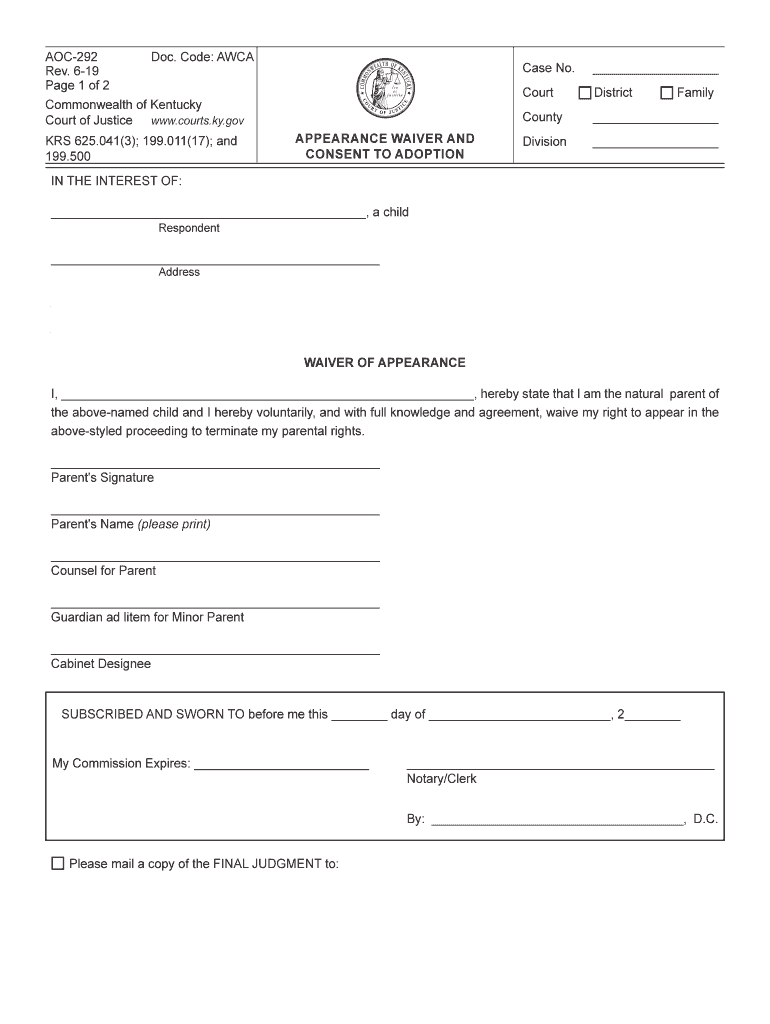

Step Parent Adoption S Tennessee 20192025 Form Fill Out and Sign, Click on federal or kentucky to edit. The individual income tax rate for 2025 has also been established to be.

2025 K 4 Form Printable Forms Free Online, 15 by the state revenue department. Kentucky’s 2025 withholding formula was released dec.

Ky K4 Form 2025 Printable Forms Free Online, This amount will be incorporated into 2025 tax forms and should be used for tax planning in the new year. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet.

JNVST Online Admission Form 2025 Class 9th Navodaya Class 9 Online, Kentucky’s 2025 withholding formula was released dec. This amount will be incorporated into 2025 tax forms and should be used for tax planning in the new year.