Ira Income Limits 2025 Over 55

Ira Income Limits 2025 Over 55. The ira contribution limit is $7,000, or $8,000 for individuals 50 or older in 2025. The contribution limit for a roth ira is $7,000 (or $8,000 if you are over 50) in 2025.

What are the ira contribution limits for 2025? Your personal roth ira contribution limit, or eligibility to.

What Is The Limit For Ira Contributions In 2025 Ilysa Leanora, The combined annual contribution limit for roth and traditional iras for the 2025 tax year is $7,000, or $8,000 if you're age 50 or older.

Ira Contribution Limits 2025 Over 55 Adah Linnie, The 2025 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older.

2025 Roth Ira Limits Fidelity Junia Beatrix, The maximum amount you can contribute to a roth ira for 2025 is $7,000 (up from $6,500 in 2025) if you're younger than age 50.

Roth Ira Limits 2025 Limits For Over Perla Brandais, The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2025 tax year was $7,000 or $8,000 if you were age 50 or older.

Roth Ira Limits 2025 Married Jaime Lillian, The contribution limit on individual retirement accounts will increase by $500 in 2025, from $6,500 to $7,000.

IRA Contribution Limits And Limits For 2025 And 2025, The ira contribution limit for 2025 is $7,000.

Roth IRA Limits for 2025 Personal Finance Club, If you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2025 and $161,000 for tax year 2025 to contribute to a roth.

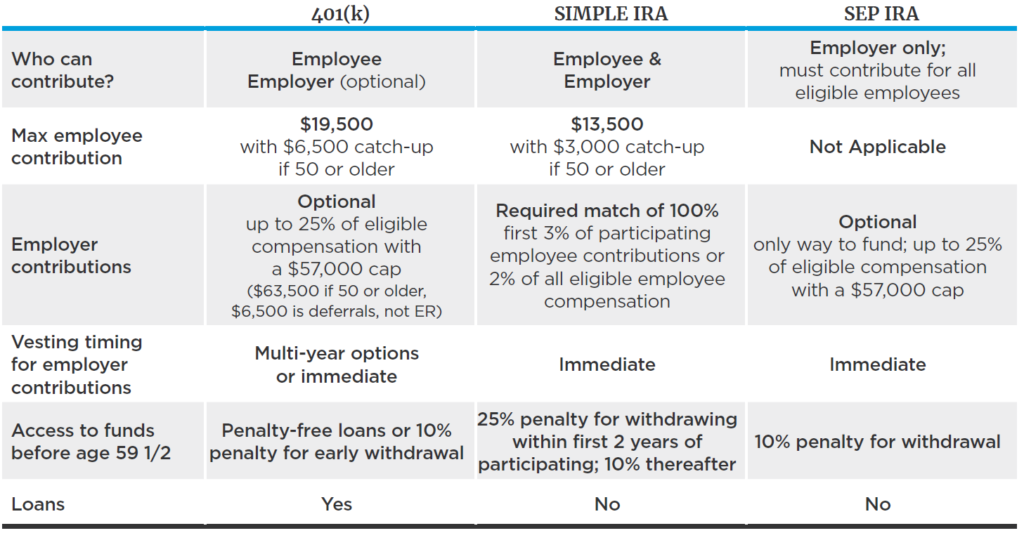

Ira Limits 2025 For Simple Tax Dynah Gunilla, Sep iras allow the freelancer's business to.

Ira Contribution Limits 2025 Catch Up 2025 Jayme Karalee, You can make a contribution to your ira by having your income tax refund (or a portion of your refund), if any, paid directly to your traditional ira, roth ira, or sep ira.